As a Singapore developer, I recently receive an email from Apple on the new GST law on digital goods & services.

Originally posted in my other blog, here is an excerpt

Due to tax regulation changes that go into effect on January 1, 2020 in Singapore, developers based in Singapore must provide their Singapore Goods and Services Tax (GST) registration status in App Store Connect by January 13, 2020.

If you provide your GST Registration Number, your proceeds will not be affected.

If you do not, you will be considered taxable per Singapore GST laws and regulations, therefore you will be charged 7% GST on WORLDWIDE commissions payable to Apple.

Please note that Apple does not administer GST on sales to customers in Singapore for developers based in Singapore. You are responsible for determining if GST applies to your sales and for remitting GST to the Inland Revenue Authority of Singapore (IRAS).

Apple gave Singapore developers 2 choices:

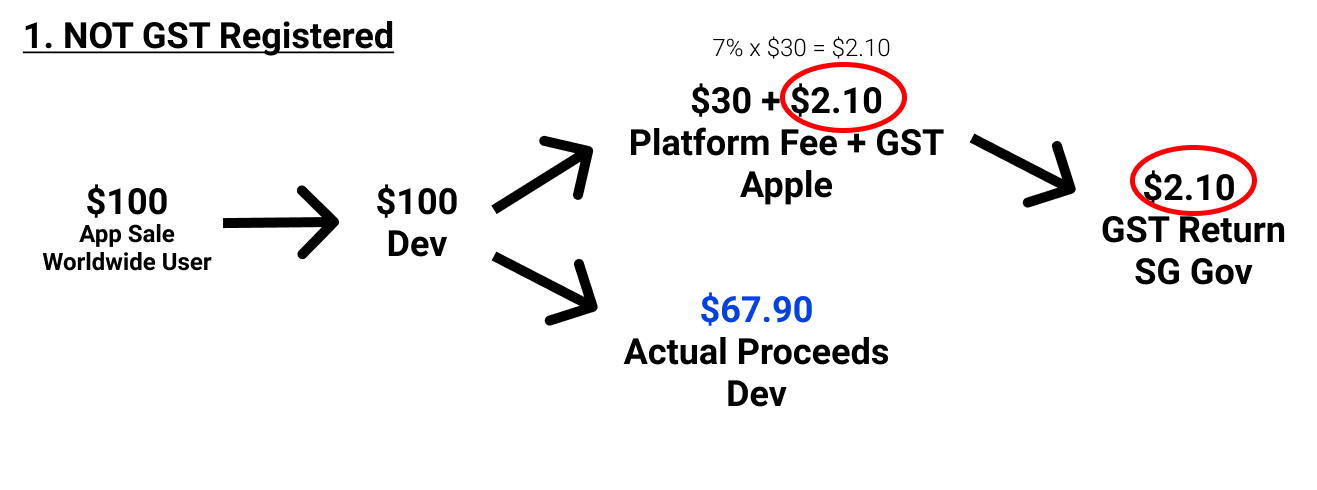

- Don’t register for GST -> Apple charge 7% on WORLDWIDE commissions payable to Apple

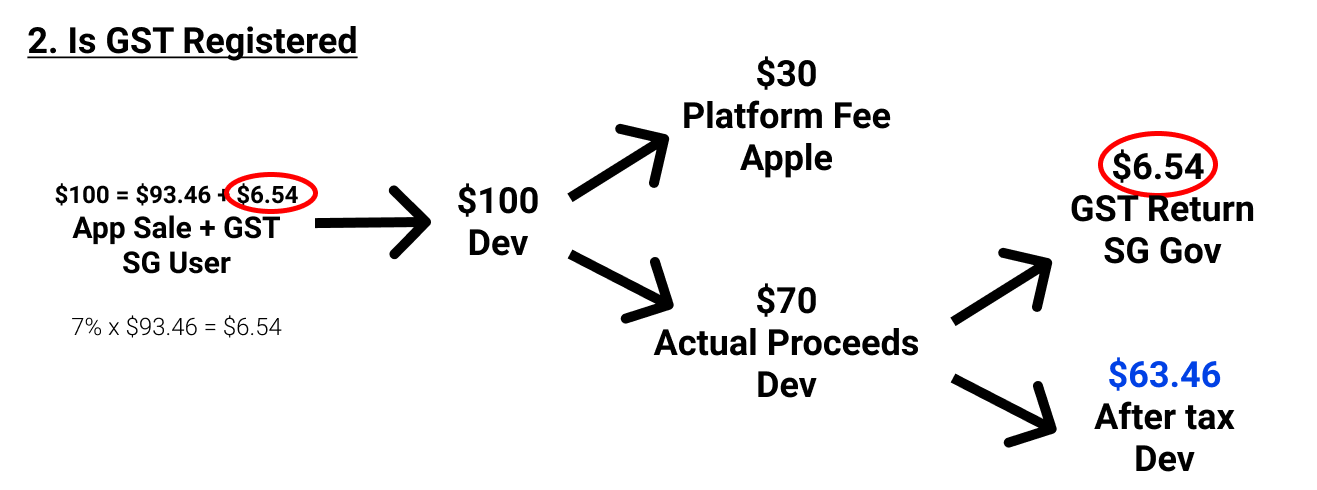

- Register for GST -> Proceeds unchanged (but you have to file GST return)

Read more here.

Overseas (non-Singapore) developers are also affected, though not strongly enforced, yet.